During the discussion portion on the motion to amend the National Bylaws, Article III, Membership at the 132nd Continental Congress it was posited by members, and by National Officers, that the amendment adding the anti-discrimination language was not only critical to maintaining the 501(c)(3) nonprofit status but was also needed in order to avoid costly property taxes assessed by the District of Columbia.

Mary Hayes speaking at the 132nd Continental Congress in June 2023; time stamp 2:29:11:

“Thank you Madam President General. My name is Mary Hayes, I’m a voting delegate, I’m a regent of the Desert Gold Chapter in New Mexico. Thank you. So my points for this are that the legal counsel has strongly advised this Bylaw because currently we’re big. It leaves it to DAR to determine what is discriminatory currently. DAR does not have the authority to determine what is discrimination under the law, and the law prohibits discrimination based on the identified characteristics in this proposed Bylaw. And this is the law that DAR must follow. The nonprofit status is a privilege. This 501(c)(3) designation by the IRS would be revoked, we would be revoked if we discriminate against protected individuals. And DAR’s history of past discrimination would be taken into account when evaluating current discrimination. DAR’s history places it at a greater risk of losing this nonprofit status. Critically, the loss of the nonprofit status would cripple the ability of this society to carry out its mission because the NSDAR would have to pay property tax on these buildings estimated at over 1 million dollars, and revenue would be severely impacted because member contributions would no longer be tax deductible.“

Sherry Edwards speaking at the 132nd Continental Congress in June 2023; time stamp 2:40:30:

“Madam President General, Sherry Edwards, Treasurer General, delegate, Molly Ockett Chapter, Maine. This is a vote about the viability of our national society for the next hundred years. If we have, we must have a Bylaw that makes clear that we will not discriminate against protected classes. If the national society discriminates, or its chapters discriminate, against a member of a protected class, we are at great risk of losing our nonprofit status. Let me reiterate what was said before, property taxes on this building, our historic buildings, would be 1.1 million dollars. We know that because we inadvertently got a tax bill that we have to dispute. Your donations to the national society and to your chapter would no longer be tax deductible. So, in my view, this is a vote about the viability of our organization for the next 125 years. Thank you Madam President General.”

Addressing these specific claims in bold:

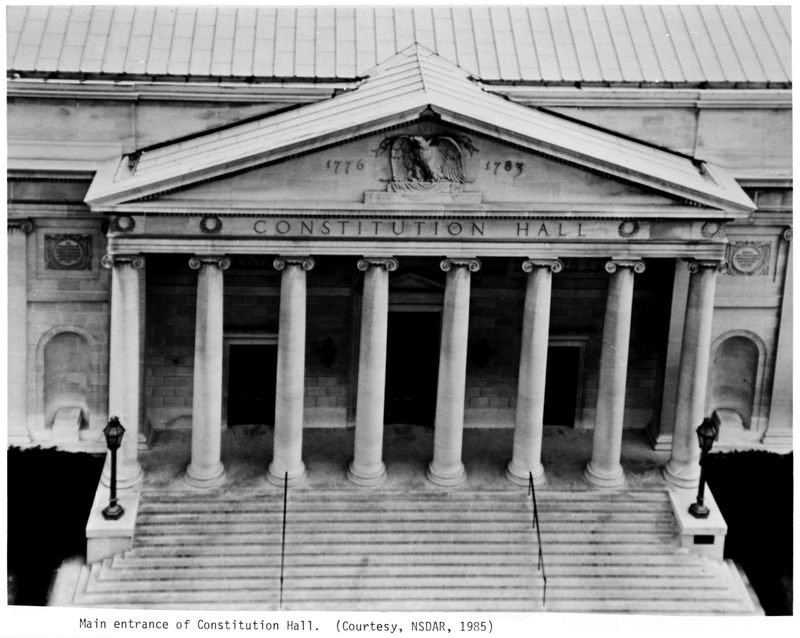

According to our research, The Daughters of the America Revolution was granted tax exempt status on properties in Washington, D.C. by an Act of Congress on February 27, 1903 that states:

An Act To exempt from taxation certain property of the Daughters of the American Revolution in Washington, District of Columbia.

This was also done in 1922 and again in 1924.

It appears that loss of property tax exemption and nonprofit status have been conflated and needs further research.

It would also appear that it would require an Act of Congress to repeal the property tax exemption granted to the DAR in 1903 and is not subject to revocation by the IRS.

No Responses